Fund Name

FT Capital Multi Class Investment Fund

Fund Name

FT Capital Multi Class Investment Fund

Class Name

US Large Cap Enhanced Complex Class

APIR

ETL9337AU

Risk Level

High

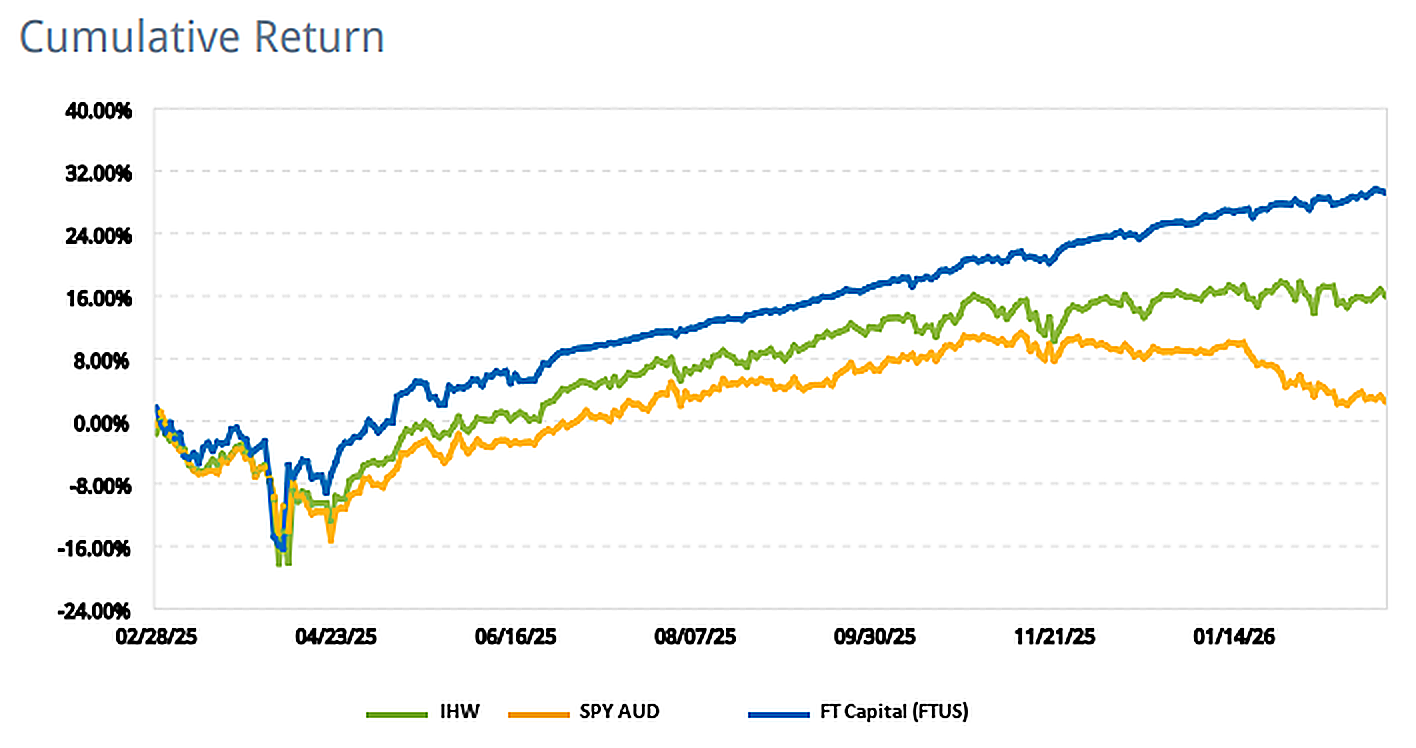

Past performance is no indication of future performance. The value of investments will vary, the level of returns will vary, and future returns will differ from past returns. Returns are not guaranteed and investors may lose some or all of their money. Remember that quoted unit prices will be historical and not necessarily the price you will receive when applying or withdrawing. Chart data may include simulated returns using verified trade data sourced from Interactive Brokers (IBKR) and is for illustrative purposes only.

Fund Snapshot

| Inception Date | February 23 2026 |

|---|---|

| Management Fee | 0.75% p.a. |

| Performance Fee | 25% p.a. of outperformance over the benchmark, calculated daily and payable semi-annually (30 June and 31 December), subject to High Water Mark. |

| High Water Mark | Applies to performance fee calculation. |

| Derivatives | Yes - exchange traded futures and options |

| Recommended Timeframe | 5 years |

| ARSN | 652 933 616 |

| Responsible Entity | Equity Trustees Limited (ABN 46 004 031 298, AFSL 240975) |

| Fund Manager | Future Trading Capital Pty Limited (ABN 43 658 713 430) |

| Administrator | Apex Fund Services Pty Ltd |

| Custodian | Apex Fund Services Pty Ltd |

Investment Framework

Efficient market exposure through exchange-traded E-mini S&P 500 futures and options.

Active strategy using futures and exchange-traded options, seeking to outperform the benchmark after fees.

Risk management overlays are applied throughout the process; risk cannot be eliminated.

Governance and Disclosure

Primary legal disclosure document for investors.

Open PDSProduct governance and distribution suitability details.

Open TMDReserved for charting, commentary, and regular reporting outputs.

Coming Soon